HDFC Bank New BizBlack Metal Credit Card

HDFC Bank has introduced four new business credit card in February 2024. We will review BizBlack Metal Edition Credit Card here. HDFC Bank BizBlack Metal Edition Credit Card is a super premium credit card for businesses. This newly launched business credit card provides much needed (55 days interest free credit) credit to businesses along with rewards on essential business expenses.

I have explained the Features, Benefits, Eligibility, Fees & Charges , Rewards and Saving on Card of BizBlack metal edition credit card in detail below:

- Features & Benefits

- Eligibility

- Fees & Charges

- Saving on Card

- Rewards

1. Features

Welcome Benefit

- Complimentary Club Marriott Annual Membership and Taj Stay voucher worth ₹5000. To avail of these benefits, cardholders must spend ₹1.5 lakh within 90 days of card issuance.

- Avail up to 20% discounts for dining, stay & spa service with Club Marriott membership across Asia – Pacific region. You can see the full details here.

Milestone Benefit

- For each spend of ₹5 lakh, BizBlack Credit Card holders can avail of a SmartBuy Flight/Taj Stay voucher worth ₹5,000.

- In a calendar year, you can earn up to 4 vouchers, i.e., up to ₹20,000 on spends of ₹20 lakh. Check complete information on milestone benefits here.

Airport Lounge Benefits

- Primary and add-on card holders can enjoy unlimited Airport lounge access to 1000+ Lounges globally.

- Unlimited Airport lounge access valid for only Active cardholders. This means credit card holder must one done at least one transaction on the card in last month.

- To view the complete list of available domestic airport lounges with the Biz Black Credit Card click here, also check the complete list of available international airport lounges.

Note – “Active Cardholder” defined as Card holder who have done minimum 1 online/In-store transaction in last month. Active Cardholder will get unlimited lounge access for current month.

– Cardholders can access International lounge using their Diners BizBlack Credit Card.

– Priority Pass is not required to access International lounge access.

– Lounge access will be applicable to last month Active cardholder.

Golf Games Privileges Benefit

- Receive 6 free golf games every quarter at 15+ Indian and 100+ global courses with Diners Biz Black Credit Card. You would also get a 100% green fee waiver across golf courses in India.

- For bookings or cancellations, you can contact 24/7 Golf Concierge Assistance at 1800 118 887 (India) or by phone at 022 42320226.

- List of Domestic & International Gold Courses details. Click here for detailed T&C and FAQ on the golf programList of Domestic & International Golf Courses details. Click here for detailed T&C and FAQ on the golf program

Concierge Services

Customize your business, travel and entertainment experiences with HDFC Bank 24 X 7 Global Concierge Assistance

Here are some of the services provided by concierge.

- Golf Booking

- Itinerary planning and reservation assistance

- Private dining assistance

- International gift delivery

- Event planning and referrals

- Airport VIP service (meet-and-greet) and much more.

- Toll Free No.: 1800118887 (India) Landline No.: 022 42320226

Customer care numbers:

- Toll Free: 1800 266 3310

- Landline: 022-6171 7606 (For customers travelling overseas)

- Email: bizblack.support@smartbuyoffers.co

Business Insurance Benefit

Card holders can avail Business Insurance at special curated pricing as per below mentioned table. Issuance of insurance is sole discretion of HDFC Bank and Insurance company without any responsibility of the blog writer.

| Business Insurance Annual Plan Details | Insurance Plan 1 | Insurance Plan 2 | Insurance Plan 3 | Insurance Plan 4 |

| Fire & Burglary insurance for Shop (excluding Theft) | 5,00,000 | 10,00,000 | 20,00,000 | 50,00,000 |

| Cash in Safe | 25,000 | 50,000 | 1,00,000 | 2,50,000 |

| Cash in Transit | 25,000 | 50,000 | 1,00,000 | 2,50,000 |

| Electronic Equipment insurance (excluding terrorism) | 50,000 | 1,00,000 | 2,00,000 | 2,50,000 |

| Hospital Cash: Accident Only Amount Payable/ Day (30 Days Cover) | 1,000 | 1,500 | 2,000 | 5,000 |

| Hospital Cash: Illness Only Amount Payable/ Day (30 Days Cover) | 1,000 | 1,500 | 2,000 | 5,000 |

| Total Premium without GST | 3,207 | 6,221 | 12,442 | 23,886 |

| Total Premium with GST | 3,785 | 7,341 | 14,681 | 28,185 |

2. Eligibility

HDFC Bank Biz Black Metal Credit Card is a premium Business Credit Card. Eligibility criteria for HDFC Biz Black Metal edition credit card is mention below:

A Self Employed Indian Citizen aged between 21 yrs. to 65 Yrs.

Annual ITR above Rs 21 Lakhs

(Customers can apply credit card using ITR, GST returns, Bank Statements and Merchant payment report)

Click here to read on The Best Personal Finance Blogs in India

3. Fees & Charges

HDFC Bank BizBlack Metal Credit Card Joining Membership Fee is Rs. 10,000/- plus applicable taxes. There is Annual / Renewal Membership Fee of Rs.10,000/- plus applicable taxes.

Spend Rs.1.5 Lakhs in first 90 days of card issuance to get First Year Joining Fee waived off (Applicable for fresh issuance only)

Spend Rs. 7.5 Lakhs in an anniversary year (12 billing cycles) and get Annual / Renewal Fee waived for next renewal year.

Cash Advance Charges – 2.5% or Rs. 500

Interest Rate – 1.99% Monthly (23.88% Annually)

Reward Point Redemption Fee – Nil

Add on Card Fee – Nil

Foreign Currency Markup – 2% of the Total Transaction Amount

Note – Fee and charges are subject to change and are sole discretion of HDFC Bank. Please Click here to view the fees and charges applicable on your HDFC Bank Biz Black Credit Card.

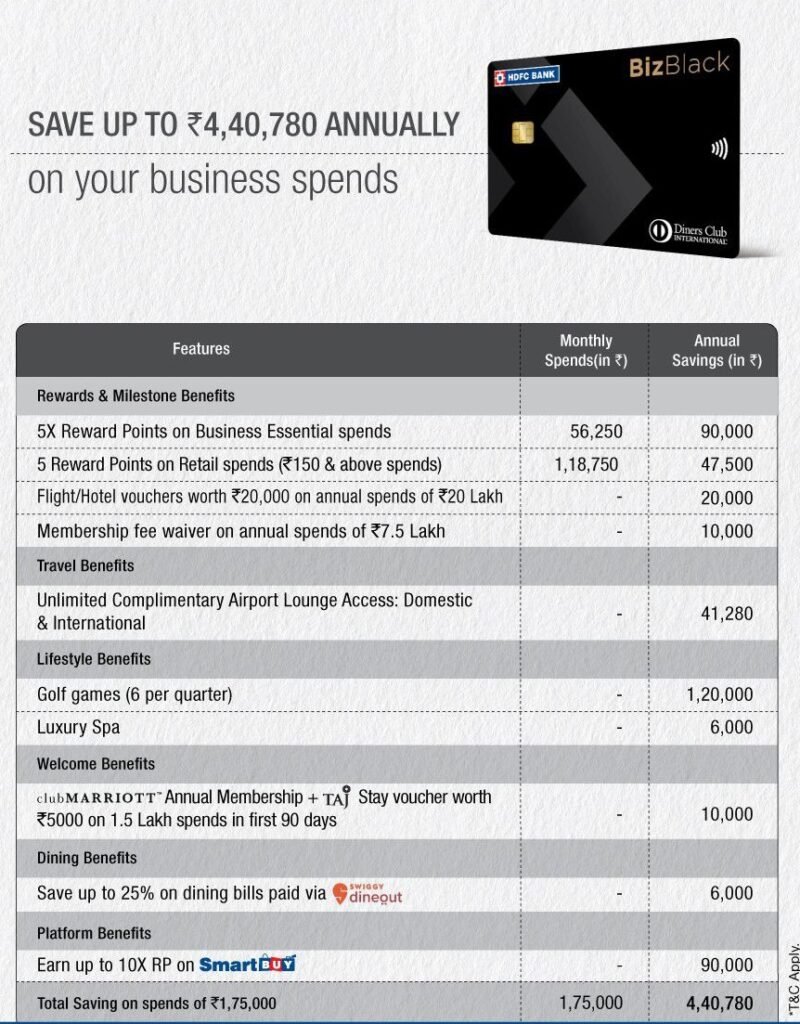

4. Saving on Card

You can save up to ₹ 4,40,780 annually on BizBlack Credit Card. Now you must be thinking , How you can save this money ? How its possible? I have provided annual saving on biz black metal edition credit card below for your convivence in detail.

5. Rewards

Biz Black Metal Edition Credit Card Reward Point Program is an impressive reward program, especially for the accelerated spend categories. Card holders have various redemption options, including cashback against statements and product catalogs. For larger enterprise seeking a premium credit card tailored to your business needs, the card’s extensive rewards and travel perks make it a standout choice.

How to earn and accumulate reward point ?

You can earn a maximum of 7,500 RP at an accelerated 5X rate per statement cycle.

Rewards Points earned for Insurance transactions will be capped at 5,000 per day.

Reward Points for grocery purchases are capped at 2,000 points per month.

On the HDFC Bank SmartBuy portal, the redemption of Reward Points for flights & hotel bookings will be capped per calendar month at 75,000 Reward Points.

All about how to redeem reward points?

- You would need a minimum of 2,500 points for redemption.

- For hotel and flight bookings, reward points can be redeemed for a maximum booking value of 50%. The rest shall be paid through the credit card.

- There is a maximum limit of 150,000 reward points that can be earned each statement cycle.

- Reward points are valid for 3 years.

Disclaimer : The content/reviews on moneyinflow.in is prepared by our in-house staff. We strive to ensure the accuracy of the information provided. However, we cannot guarantee the reliability of all credit card details as these are always subject to change and sole discretion of the card issuer. We here by advice you to review the specific terms and conditions for the credit card on the card issuer’s website.

Well articulated, real benefit of 4 lacs per Annum is good offering but joining fee seems to be entry barrier for small business owners

Pingback: HDFC Bank Biz Power Credit Card Detailed Review Money Inflow

Pingback: HDFC Bank Biz Grow Credit Card benefits features Moneyinflow