HDFC Pixel Play Credit Card Features, Benefits and Review in Detail

HDFC Bank has Introduced digital PIXEL credit cards named PIXEL Play recently. Pixel Play credit card from HDFC Bank is first end-to-end mobile app-based customisable, DIY digital card designed for Digital Natives. PIXEL is tailored for a generation characterised by digital fluency, unique preferences, and distinct financial behaviors. You can avail and manage this credit cards digitally via PayZapp app. HDFC PIXEL cards offer cashback benefits to the cardholders, moreover PIXEL Play card users also get the option to customise their cashback earning categories, card design and billing cycle date.

How to Get a Lifetime Free Credit Card Without Income Proof

After complete research on the credit card, detailed information for review on HDFC Pixel Play Credit Card in structured manner is mentioned below. Read on to know more about HDFC Bank PIXEL Credit Cards.

- HDFC Bank Pixel Play Credit Card Eligibility

- HDFC Bank Pixel Play Credit Card Fees & Charges

- HDFC Bank Pixel Play Credit Card Features and Benefits

- HDFC Bank Pixel Play Credit Card Rewards

- HDFC Bank Pixel Play Credit Card Review & Summary

1. HDFC Bank Pixel Play Credit Card Eligibility

HDFC Bank Pixel Play is a entry level digital credit card which is meant for young digital savvy generation. hence HDFC bank has positioned it as PIXEL – BORN DIGITAL FOR THE BORN DIGITAL. Pixel Credit Card is a digital credit card and can be issued to salaried as well as self employed customers. Below are the eligibility criteria for Pixel Play Credit Card

Eligibility for Salaried Customers

- Age limit – Minimum 21 Years and Maximum 60 Years.

- Nationality – Applicant should be Indian citizen

- Income Criteria – Applicant should have Gross monthly income more than Rs 25000/-

- Documents Required – Applicant can apply for credit card using last 3 months salary slip, PAN Card, ID Proof, Address Proof, and Bank Statements

Eligibility for Self Employed Customers

- Age limit – Minimum 21 Years and Maximum 65 Years.

- Nationality – Applicant should be Indian citizen

- Income Criteria – Applicant should have ITR income more than Rs 6.0 lakhs per annum

- Documents Required – Applicant can apply for credit card ITR, PAN Card, ID Proof, Address Proof, and Bank Statements

2. HDFC Bank Pixel Play Credit Card Fees & Charges

Pixel Play is an entry level credit card; therefore joining fee for the card is low. We believe every credit card holder must be aware about applicable charges, hence we have provide below are some common charges applicable (these charges are subject to change without any prior notice and sole discretion to credit card issuance company)

- Joining Fee – Rs 500 Plus applicable taxes, if you Spend Rs 20,000/- within first 90 days from receiving of the credit card, Joining fee is waived which make this card as good as free even if you have average spending of Rupee 7,000/- to 8,000/- a month.

- Renewal Fee / Annual Fee – Rs. 500 Plus applicable taxes

- Spend Based Waiver – Renewal Fee is waived on Spends of Rupee 1 Lakh in a card Anniversary Year.

- Foreign Currency Markup – 3.5%

- Interest Rate- 3.60% Monthly (43.20% Annually)

- Cash Advance Charges – 2.5% OR Rs. 500/- Whichever is higher.

3. HDFC Bank Pixel Play Credit Card Features and Benefits

- Welcome Benefits / Activation Benefits:

HDFC Pixel Play Credit Card offers Get a joining fee waiver by spending ₹20,000 within 90 days of issuance Hence act fast to activate your card and do 1st online transaction soon after receiving the credit card within first 90 days of card issuance.

- Milestone Benefits:

Pixel Play Credit Card don’t offer milestone benefits. We advise you to check for premium and super premium credit cards for enjoy milestone benefits.

- Dinning Benefits:

HDFC Bank Pixel Play Credit Card offer Exclusive Dining Privileges. You can enjoy amazing dining benefits with Good Food Trail program. Card Holder gets up to 25% savings off on all your restaurant bill payments via Swiggy Dineout (Swiggy Dineout Logo) (20k + restaurants) (Offer inclusive of Restaurant and Swiggy Discount). Offer valid only on payments done via Swiggy App.

- Fuel Surcharge Waiver Benefits:

1% fuel surcharge waiver at all fuel stations across India (on a minimum transaction of ₹400 and a maximum transaction of ₹5,000. Maximum waiver of ₹250 per statement cycle).

- Domestic Lounge Access Benefits:

HDFC Pixel Play Credit Card don’t offer domestic lounge access . we recommend you to look for premium or super premium credit card if you travel frequently and want to make use of lounge access.

- International Lounge Access Benefits:

HDFC Bank pixel power credit card is a entry level card and it has limitation on lounge access, hence pixel play card don’t offer on international lounge access.

- Concierge Services Benefits

HDFC Bank do not offer Concierge Service with Pixel Play Credit Card. Concierge Services are available with HDFC Bank Biz Black Metal edition credit card. Please visit our blog on HDFC Bank Biz Black Metal Edition Credit Card.

- Golf Games Benefits

Golf Games Benefits are not available with HDFC Bank Pixel Play Credit Card. HDFC Bank offers Golf Games Access Benefit with HDFC Bank Biz Black Metal edition credit card. For Details on Golf Games Benefits Please visit our blog on HDFC Bank Biz Black Metal Edition Credit Card.

- Renewal Fee Waiver Benefits

Renewal Fee waived off if you spend Rs 1 Lakh and more in the previous year.

- Zero Liability Protection Benefits

In the unfortunate event of losing your PIXEL Play Credit Card, on reporting it immediately to our 24-hour call centre, Cardholder have zero liability on any fraudulent transactions made on your Credit Card.

- Additional Benefits

Interest Free Credit Period : Up to 50 days of interest free period on your PIXEL Play Credit Card from the date of purchase (subject to the submission of the charge by the Merchant)

Revolving Credit : Available at a nominal interest rate on your PIXEL Play Credit Card. Please refer to Fees and Charges section to know more.

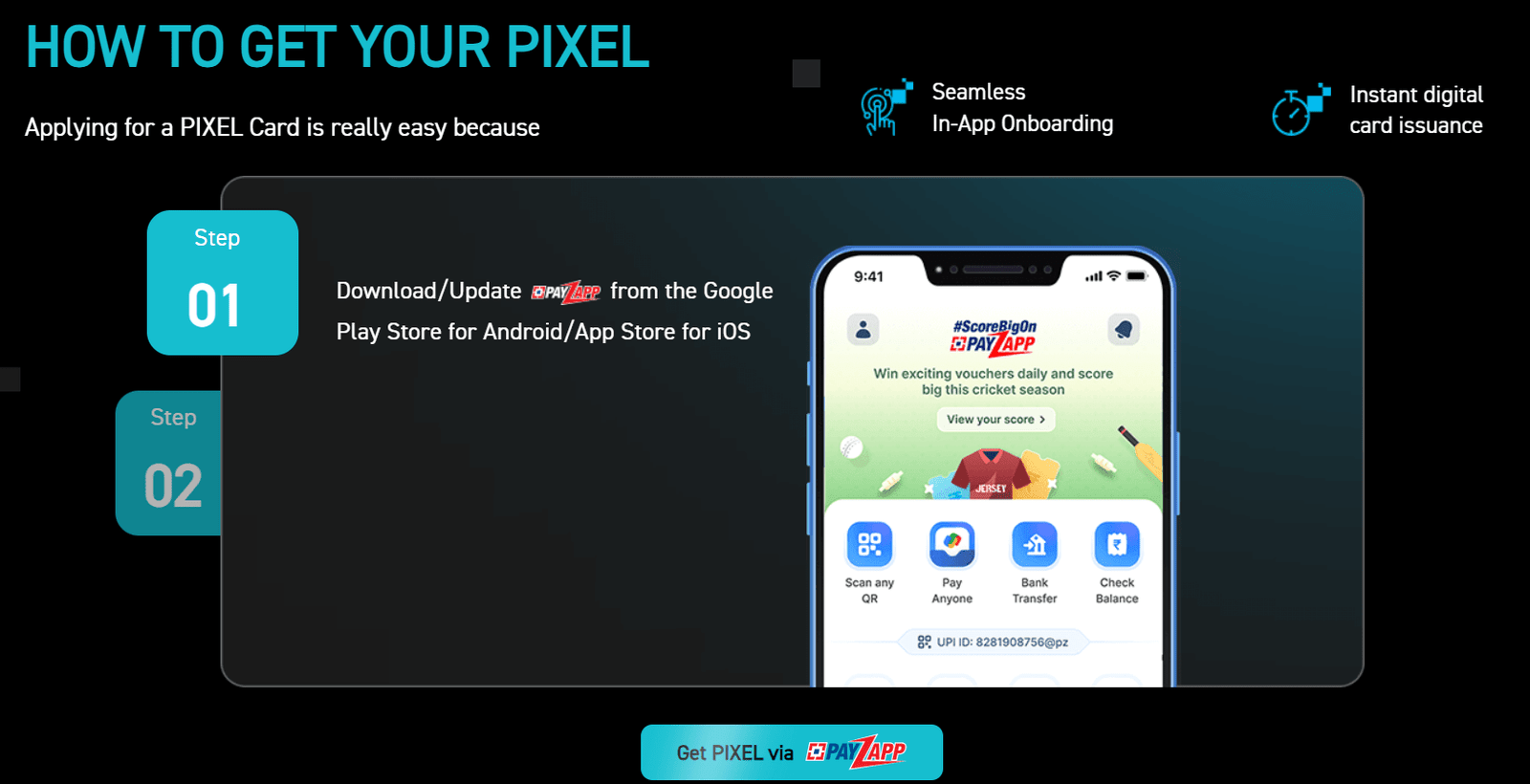

Seamless Digital Onboarding – Experience a seamless digital onboarding via PayZapp and receive an instant digital credit card.

Customize your card – Select merchants of your choice to earn cashback, choose card design, and select your preferred billing cycle date.

All in One-App – Digitally manage your PIXEL Play credit card from PayZapp. Access features such as Card Controls, Rewards, EMI Dashboard, Statements, Repayments, Recent Transactions, Disputes, Hotlisting, Help Center, Notifications, and much more

Enjoy hassle-free, one-click instant conversion of the PIXEL Play credit card outstanding balance* to EMIs from your PayZapp.

EMI Dashboard: Manage all your live EMIs within the EMI dashboard from PayZapp.

Flexibility: Choose low-cost and flexible tenures that suit best for your choice of repayment. You can choose between select transactions or outstanding balances*.

100% Digital: No documentation, email, or calling required. Simply convert to EMI and manage EMI repayments fully from your Payzapp.

4. HDFC Bank Pixel Play Credit Card Rewards

5% Cashback on choice of any two packs :

– Dining & Entertainment Category – BookMyShow & Zomato

– Travel Category – MakeMyTrip & Uber

– Grocery Category – Blinkit & Reliance Smart Bazaar

– Electronics Category – Croma & Reliance Digital

– Fashion Category – Nykaa & Myntra

3% Cashback on choice of any one E-commerce merchant

– Amazon or Flipkart or PayZapp

1% Unlimited Cashback across all other spends. Click here for more details on rewards

Cashback will be credited in the form of PIXEL CashPoints and can be easily managed under the rewards section of the Pixel Homepage in Payzapp.

Upon the accumulation of 1000 PIXEL CashPoints, they can be redeemed easily to the PayZapp Wallet and used to purchase your choice of brand vouchers within PayZapp digitally.

Pixel CashPoints are valid for 2 years from the date of accumulation.

How to Claim Credit Card Reward Points

The cashback will be credited as Pixel CashPoints in PayZapp. On accumulating 1,000 points, it can be redeemed and used to purchase your choice of brand vouchers within PayZapp. CashPoints are valid for two years from the date of accumulation.

5. HDFC Pixel Play Credit Card Review / Summary:

HDFC Bank Pixel Play Credit Card offers unique feature of card customisation with low joining fee, moreover this fee can also be reversed based on spend within the limited time.

Additionally, The cashback will be credited as Pixel CashPoints in PayZapp. On accumulating 1,000 points, it can be redeemed and used to purchase your choice of brand vouchers within PayZapp. CashPoints are valid for two years from the date of accumulation.

HDFC has offered Pixel Credit Card in two variants PIXEL Play and PIXEL Go, PIXEL Go is a credit card for beginners looking to enter the world of credit cards and build their credit scores with flexibility of payments through Pay-in-Parts. Click here to read our HDFC Pixel Go Credit Card Review.

Limitation of hdfc pixel Credit Card

HDFC Pixel Credit Card has limitation of cashback feature, where card holders won’t get the cashback in the form of cash, like other regular credit cards. Cashback points with Pixel play card can be redeemed against vouchers only from PayZapp.

HDFC Bank Pixel Play card is an entry-level credit card, the interest seems to be at the higher side. The interest rate on the overdue amount is 3.60 percent per month, or 43.20 percent annualised.

Pixel Paly credit card doesn’t offer domestic or international airport lounge access.

HDFC Bank has specified select merchants under all categories to earn the 5 percent cashback. For example, in the dining and entertainment category, the merchants are BookMyShow and Zomato. There is no option for swiggy. Similarly, while shopping for electronics, you can choose from Croma and Reliance Digital. Card holder won’t get 5 percent cashback on all merchants within a category i. e., if you buy electronics from Vijay Sales, you will not get 5 percent cashback. You will only get 1 percent.

Overall, This credit card stands out as a convenient choice for individuals looking to make their purchases more rewarding while not spending much on fees.

PIXEL PLAY Credit Card Vs. PIXEL GO Credit Card by HDFC Bank

| PIXEL PLAY CREDIT CARD | PIXEL GO CREDIT CARD | |

| Fee | Joining and renewal membership fee is Rs. 500/- Plus applicable taxes | Joining and renewal membership fee is Rs. 250/- Plus applicable taxes |

| Age | Salaried – 21 Years to 60 Years Self Emp. – 21 Years to 65 Years | Salaried – 21 Years to 60 Years Self Emp. – 21 Years to 65 Years |

| Income | Salaried – minimum gross monthly income of ₹25,000 Self Emp. – annual Income Tax Return (ITR) of over ₹6.0 lakh. | Salaried – minimum gross monthly income exceeding ₹8,000 Self Emp. – annual Income Tax Return (ITR) of over ₹6.0 lakh. |

| Joining Bonus | When you spend ₹20,000 within 90 days of receiving your card, you will receive a joining fee waiver | By spending ₹10,000 within 90 days of receiving your card, you can qualify for a joining fee waiver |

| Renewal Waiver | If you spend ₹1 lakh or more in the preceding 12 months, your renewal membership fee for the next year will be waived | You can spend ₹50,000 or more in the previous 12 months and waive your renewal membership fee for the following year |

| Cashback | HDFC Bank offers a customisable rewards program on Pixel Play Credit card where you get to choose the merchants you want to earn CashBack on. Additionally, you have the option to choose your card color and preferred billing cycle date. The reward structure is as follows: 5% Cashback on any two selected merchant categories: Dining & Entertainment: BookMyShow and Zomato Travel: MakeMyTrip and Uber Grocery: Blinkit and Reliance Smart Bazaar Electronics: Croma and Reliance Digital Fashion: Nykaa and Myntra 3% Cashback on one chosen e-commerce merchant: Amazon OR Flipkart OR PayZapp 1% Unlimited Cashback: You can earn 1% unlimited cashback on all other expenses. | Cashback on All Spends: PIXEL GO Credit Card by HDFC Bank offers 1% unlimited cashback on all eligible transactions |

How to apply for HDFC Pixel Credit Card

You can easily apply for the PIXEL Play Credit Card by following the steps below:

Step 1: Download or update the PayZapp app from the Google Play Store for Android or the App Store for iOS

Step 2: Click on the ‘Apply Now for PIXEL Play’ banner on the PayZapp homepage

We are tried our best to give the maximum information on this newly launched credit card, what are your thoughts on HDFC Bank Pixel Play Credit Card? Let us know in the comments below.

Frequently Asked Question – FAQ

- What are PIXEL CashPoints?

PIXEL CashPoints are exclusive Reward metric system created for our PIXEL Play Credit Card holders

- What are the key features of the HDFC Bank PIXEL Play credit card?

Earn 5% CashBack of up to ₹500 per month on any two packs of your choice

- Dining & Entertainment Category – BookMyShow & Zomato

- Travel Category – MakeMyTrip & Uber

- Grocery Category – Blinkit & Reliance Smart

- Electronics Category – Croma & Reliance Digital

- Fashion Category – Nykaa & Myntra

Earn 3% CashBack of up to ₹500 per month on any one E-commerce merchants of your choice

PayZapp | Amazon | Flipkart

1% unlimited CashBack on all other spends

Choose the card design & Billing cycle date that suits you.

- How many merchant categories (Pack) can I select for 5% CashBack?

You can select any 2 two packs from the available 5 packs under 5% CashBack and you can change to new packs once in every three months.

- How many merchants can I select for 3% CashBack?

You can select a maximum of one merchant under the 3% CashBack benefit and you can change the merchant once in every three months.

- When will my earned CashBack be added to the Rewards Balance?

The eligible transaction CashBack will be added to the cashpoint balance post successful settlement of the transaction from the merchant.

- How do I redeem the CashBack accrued on my PIXEL Play Credit Card?

The accrued CashBack in the PIXEL Play Credit Card can be redeemed from the Rewards Page in the PIXEL Play Credit Card homepage via PayZapp app.

The redeemed CashPoints will be transferred to PayZapp Cashpoint account post redeeming in the app. For redeeming the CashPoints, you must have minimum 1000 CashPoints.

- Is there any capping for CashPoints earned on PIXEL Play Credit Card?

There is no capping on the CashPoints earned under the 1% CashPoints feature in the card other than the insurance transaction.

- What is the capping of CashPoints on Insurance Spends?

The CashPoints for Insurance Spends will be capped at 2,000 CashPoints per day.

- What is the validity of CashPoints accrued on my PIXEL Play credit card?

Unredeemed CashPoints will expire/lapse after 2 years of accumulation.

- I did a transaction of ₹260 and earned only 2 CashPoints. Why did it happen?

CashPoints will be calculated and posted on round down integer, the transaction of ₹260 transaction will be calculated as (260*1% = 2.6 CashPoints = 2 CashPoints (round down integer). Fractional CashPoints will not be accrued.

- Why am I not getting CashPoints on all the spends?

CashPoints shall not be eligible for the following spends/transactions on the card:

- Fuel Spends

- Wallet Spends/ Gift or Prepaid Card load/ Voucher purchase

- Rent payments

- Government related transactions

- EMI Transactions

- Purchases converted to EMI post facto

- Cash Advances

- Payment of Outstanding Balances, card fees and other charge.

- What is Pay in Parts?

You can enjoy hassle free one-click instant conversion of the PIXEL Play Credit Card outstanding balance* to EMI’s from your mobile app. You can choose low-cost, flexible tenure that suits your repayment preferences, allowing you to choose between transactions or outstanding balances*.

- Are there any transactions excluded from Pay in Parts conversion?

Gold and Jewelry linked transaction is not permitted for conversion into Pay in Parts due to policy guidelines. On availing the EMI facility, the CashPoints if any that have been accrued on the original transaction shall be reversed.

- What are the Fees and Charges applicable on the PIXEL Play Credit Card?

First Year Membership Fee – ₹500/- + Applicable Taxes, Renewal Membership Fee – ₹500/- + Applicable Taxes

Spend Rs 20,000 in first 90 days and get the Joining fee waived off

Spend Rs 1,00,000 or more in the preceding 12 months and get renewal membership fee waived off for next year.

- What is the Swiggy Dineout Offer in PIXEL Play Credit Card?

You will get Up to 25% savings on PIXEL Play credit card payments via Swiggy Dineout Pay App.

You can earn maximum of ₹300 per month.

The stated offer is valid till 31st December 2024

- Who is eligible for a PIXEL Play credit card?

Customer Profile Criteria

Salaried Age: Min 21 Yrs & Max 60 Yrs

Income: Net Monthly Salary > ₹25,000

Self Employed Age: Min 21 Yrs & Max 65 Yrs

Income: ITR > ₹6 Lakhs per annum

Disclaimer: This blog is published for convince of website users and support financial literacy/ education purpose on best effort basis. Information published here are subject to change/modification as and when credit card issuing bank decide to change. Issuance of credit card, change/modification in Fees, Charges, Terms and conditions, Benefits, and feature are sole discretion of Card issuing bank/HDFC Bank. Please visit credit card issuing bank website or branch before applying for credit card. The Blog writer and moneyinflow.in shall not be held responsible for any change made by credit card issuing bank.

Damn good credit card from hdfc bank. Very well written by you all the details are covered

Pingback: HDFC Pixel Go Credit Card (new) Detailed Review Money Inflow