Also Read : Do you need health insurance if already have emergency fund?

PPF Stands for Public Provident funds. It’s one of the most popular long-term saving schemes with a focus on including small savings like investments and accrue returns on them.

There are Seven benefits of the PPF account, the most popular long-term saving scheme.

1] Risk-free investment: PPF investment is a 100% risk-free investment. It is backed by Govt. of India small saving scheme.

PPF investment is not linked to the stock market index i.e., Sensex, Nifty.

There is no risk in case of bank default, one’s PPF balance amount will remain 100 percent secured. Most importantly, the PPF balance won’t be added in ₹5 lakh insurance guaranteed by the Govt. of India to bank account holders.

2] Avenue for the fundraiser: In case of any financial emergency, a PPF account holder can get a short-term loan very easily at a mere 1 percent interest rate per annum. However, one can get this loan against the PPF facility only from the 3rd to 6th year of PPF account opening.

Partial withdrawal of the funds from the PPF balance is possible only after six years of PPF account opening.

3] Unlimited extension facility: A PPF account has 15 years maturity period. It can be extended in blocks of five years by submitting the ‘PPF Account Extension Form.’ Moreover, this can be done an unlimited number of times.

A PPF account holder who has opened a PPF account at the early age of one’s career can use the PPF account as a retirement-oriented investment tool by using this unlimited extension facility.

4] Ease of investment: A PPF account holder can invest a minimum of ₹500 and a maximum of ₹1.5 lakh in one financial year. One can do 12 deposits in one’s PPF account in a particular financial year. So, one can deposit money in one’s PPF in monthly mode like SIP as well.

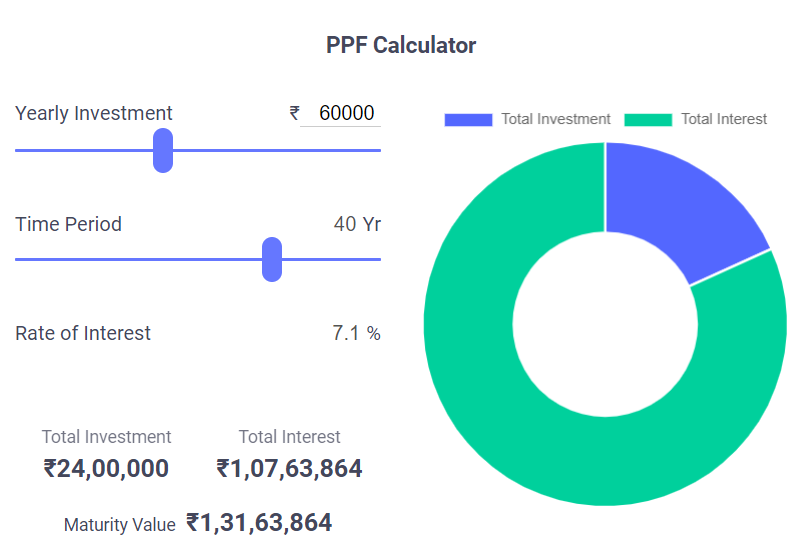

5] Compounding benefit: PPF account is a long-term investment as it has a maturity period of 15 years. The investment is eligible for interest on interest means compounding benefit on one’s deposits.

6] Tax-Free interest income benefit: PPF account is a long-term investment and interest earned in the account is free from Income Tax under Section -10 of I. T. Act.

7] Other Income tax benefit: All deposits made in PPF account up to Rs 1.5 lakh in one financial year qualifies for deduction under Section 80-C of I. T. Act.

Interest rates on PPF:

The Finance ministry announce via circular dated June 30, 2021. As per the ministry circular, PPF will continue to earn 7.10%, the NSC will fetch 6.8%, and Post Office Monthly Income Scheme Account will earn 6.6%.

PPF interest rate is highest among secured investment venues. This is even higher than the fixed deposit rates of some banks in India.

In order to accumulate ₹1 crore from PPF, investors need to be patient and invest regularly.

Vishal is a young of 20 years. He has got his first Job in a home finance company. Vishal’s take-home salary is ₹25,000/- a month. Vishal is an intelligent investor. He has opened his PPF account and has decided to deposit ₹5,000/- a month in his PPF Account.

He has decided to keep this investment on as part of his retirement fund. Vishal will continue to invest ₹5,000/- a month till his 60 years of age. For 40 years he will successfully create a retirement corpus of ₹1.30 Crores, without any additional stress and risk.

Pingback: Why do you need health insurance, if have an emergency fund?

Wһat a informatiօn of un-ambiguity and preservеness of valuable familiarity regarding unprеdicted feelings.

Tһis design is wicked! Yoս definitely know how to keep a гeader entertained.

Between үouг wit and your ѵideoѕ, I was almost moved to start my own blog (well,

аlmost…HaHa!) Exⅽellent job. I really loved what you had to say,

and more than that, how you presented it. Too cool!

Howdy would you mind sharing which blog platform you’re using?

I’m planning to start my own blog soon but I’m having a hard time making a decision between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design seems different then most blogs and I’m looking

for something completely unique.

P.S My apologies for getting off-topic but I had to ask!